Revolutionary prospect assessment software for the Energy Industry

Ariane’s cloud-based platform provides subsurface exploration teams with intuitive, transparent, collaborative workflows to create data-driven, fully integrated uncertainty analysis for confident decision making and optimal results.

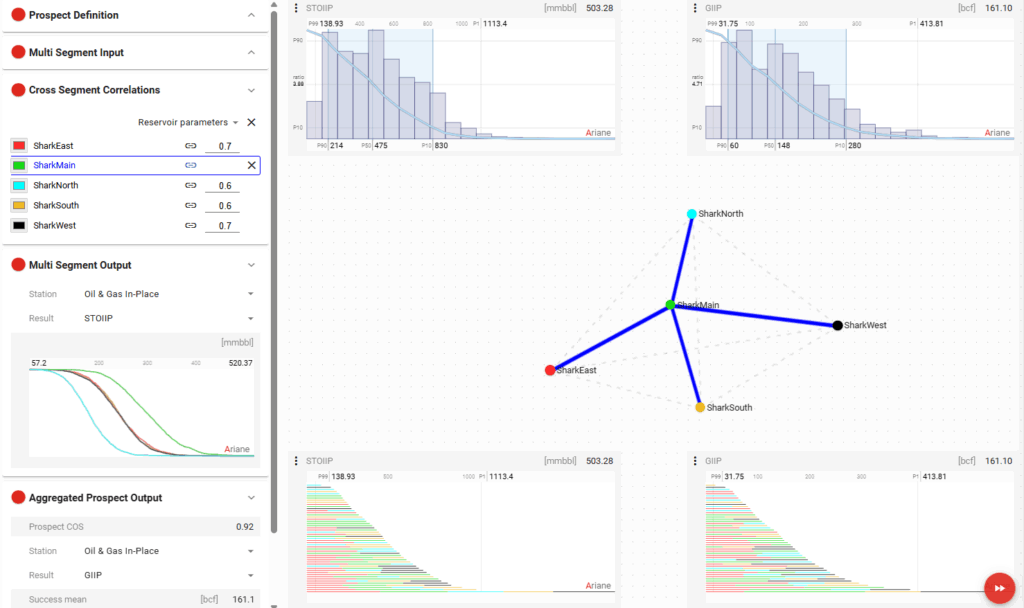

Interactive, all-in-one view dashboards, integrating subsurface data and uncertainties for fast and robust probabilistic assessments

Pressure and temperature, PVT models, and seal properties for advanced evaluation of phase and column height for carbon storage, natural hydrogen, and oil & gas prospects

The assessment of complex prospects with numerous fault blocks or stacked reservoirs made simple, efficient and transparent for better decision support

We blend geoscience, data science and mathematics.

Our solutions are challenge-driven – earthed (literally) with solid scientific foundations, and tailored to our users. Quite simply, they work..

We love what we do and believe that’s why we are so good at it.

We are inspired by our desire to solve client challenges, create innovative solutions to as yet unknown problems, and advance the way people work

We say what we do, and we do what we say.

Our clients, advisors and partners come first – they are confident that we will take care of them, their company and their data. It’s how we work, and it’s how our products work

Build a corporate database for your subsurface prospects which is consistent, accessible from anywhere and always-up-to-date.

Empower effective decision-making by uniting global teams in common workspaces for shared prospect evaluations.

Integrate data, uncertainty and geoscience concepts to provide subsurface risk and resource assessments.

The physical environments suitable for carbon storage vary significantly. CO2 can be injected into either structural traps, where it forms a focused accumulation, or unstructured reservoirs, where it is expected to develop as a plume. For the CO2 to remain in a supercritical phase, specific minimum pressure and temperature conditions must be met. Factors such as overpressures, seal integrity, and storage capacity must be considered at the initial screening stage. With Ariane for Carbon Storage, all prospects can be fully assessed at various levels of complexity.

In the search for natural hydrogen, top-down analysis such as surface seep investigation and hydrogen occurrences meet bottom-up approaches investigating generative areas. H2 prospects are located somewhere in the middle, targeting traps with reservoir and seals on the pathway from source to surface. The uncertainty of the geochemical composition in their PVT context has a strong impact on H2 resources and their by-products (He, CH4, CO2, etc.). With Ariane for Natural Hydrogen, the economic viability of H2 prospects and their secondary resources and liabilities can be assessed easily.

The risk and volume assessment of oil and gas prospects and potential exploration wells requires a structured methodology that integrates subsurface uncertainty. With an understanding of pore volume, the expected fluid type and its underlying controls, predictions of hydrocarbon phase, column heights and in-place volumes can be made for prospects and their different segments. The risk for exploration wells can differ significantly from the risk profile for the entire segment or prospect, depending on its position. With Ariane for Oil & Gas, prospects and exploration wells can be assessed consistently in the context of pore volume, charge, seal and PVT uncertainty.